Calculate your Personal Income Tax in Canada for 2020 & 2021

Have you ever wondered which Canadian province or territory has the lowest or highest tax on personal income?

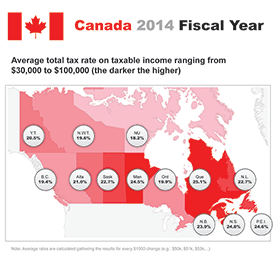

This presentation compares Canada's various tax rates and puts each province/territory on the same scale, showing you how much Canadians pay taxes depending on where they live.

Understanding Canadian Personal Income Tax with 2 Simple Charts

This is an abridged version of the full presentation.

Canada 2014 Fiscal Year; Comparing Personal Income Tax

This is an abridged version of the full presentation.

Most people have a salary where taxes are deducted automatically from the source/job on a bi-weekly basis, allowing them to have a clear vision of what their net income is. Other independent workers such as freelancers, or entrepreneurs, have to plan ahead in order to know how much they will owe back to the government. No matter the case, it is important to have a realistic view of your annual finances in order to understand how much is really available to you after paying your income taxes.

An income tax calculator will allow you to see clearly, and can also help you see the different tax brackets from province to province, which can be helpful if you're planning to move.

The following calculator is based on the 2020 & 2021 fiscal year numbers (for taxes due in spring 2021 or 2022) and uses for its calculations the official Canadian income tax rates from the Canada Revenue Agency web site, along with the Revenu Québec web site (for the province of Québec). This calculator is updated yearly, with the new yearly rates (2022, 2023, etc.)

As with many types of taxes, the personal income tax in Canada is progressive, which means higher income is taxed at a higher rate, up to a maximum percentage. In Canada, these rates also vary from province to province, which makes it a little more complicated to compare.

For example, Alberta uses lower tax rates, which can make it attractive for people with a high income. However, for an average salary worker, British Columbia or Ontario could be more affordable (without taking into consideration cost of living).

The following calculator also includes federal tax abatement for the province of Quebec, surtaxes (applicable on provinces such as Ontario, Yukon and Prince Edward Island) and basic personal income tax credit.

Do not forget to subtract the tax-deductible amounts from your annual income, such as your RRSP contribution (Registered Retirement Savings Plan). Find out how much you save in taxes with your RRSP contributions.

Please change the suggested values with your own amounts in the blue text boxes.